Could there be green shoots ahead?

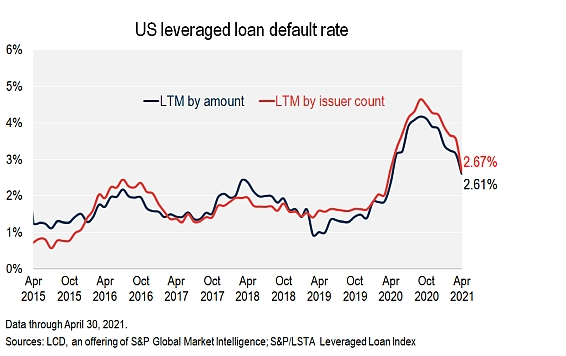

Could there be green shoots ahead? Per Standard & Poor’s Leveraged Commentary & Data (LCD), the default rate of U.S. leveraged loans dipped below the 2.9% historical average for the first time since the COVID-19 pandemic triggered a steep global recession and reset the clock on the record-long bull market cycle.

Data from LCD indicates “The default rate on the $1.2 trillion leveraged loan market could continue to fall at a rapid pace from this seven-month stretch of declines, potentially heralding the end of a year-long default cycle for the asset class. Without a fresh wave of bankruptcies and payment misses, the loan default rate could fall to less than 1% by the end of July, with nearly $24 billion due to roll off the trailing 12-month calculation between now and then. To add context, following the 10.81% November 2009 default peak, defaults did not fall below 1% for 17 months.”

Reach out to info@bancalliance.com to learn more about its Alliance Academy course offering, which provides BancAlliance Members a deep dive on the leverage finance market.